Federal Self Employment Tax Rate 2024

Federal Self Employment Tax Rate 2024. 2024 federal income tax rates these rates apply to your taxable income. This publication explains both of these methods.

Key areas for deductions include home office expenses, business expenses, health insurance, and retirement plan contributions. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Your Taxable Income Is Your Income After Various Deductions, Credits, And Exemptions Have Been Applied.

You pay tax as a percentage of your income in layers called tax brackets.

One Available Deduction Is Half Of The Social Security And Medicare Taxes.

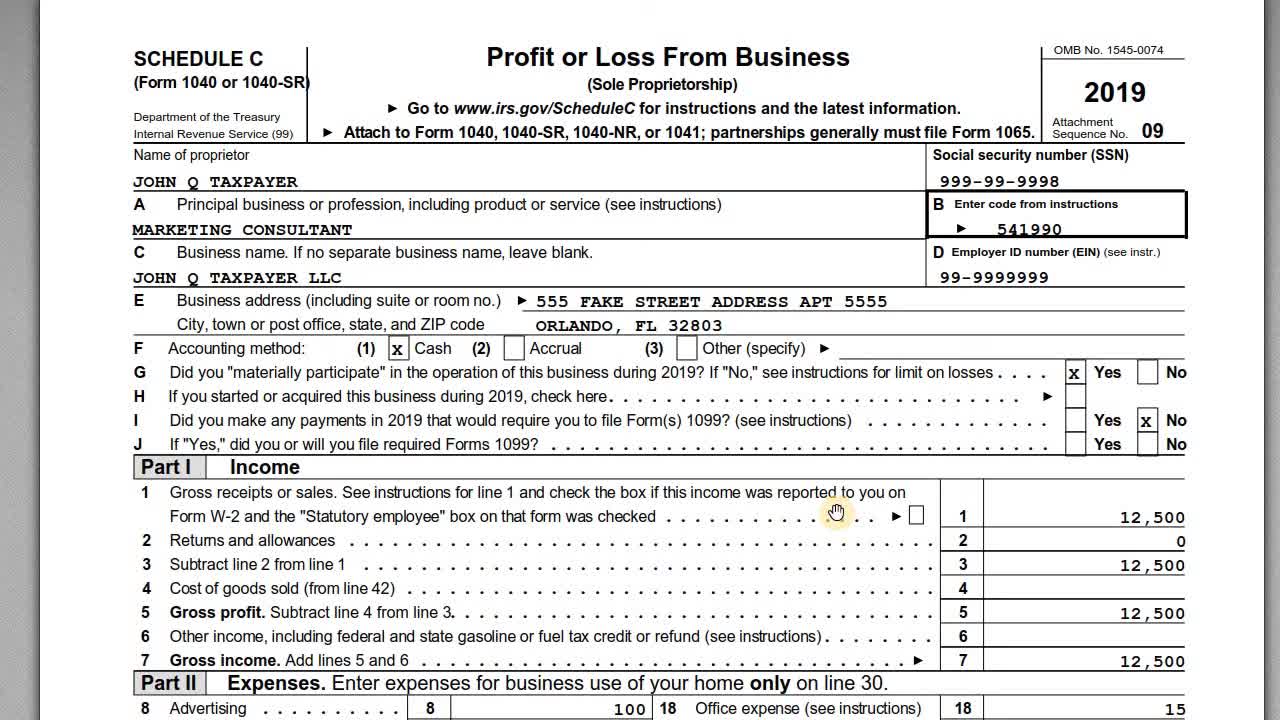

You’ll use schedule c to calculate net earnings and schedule se to calculate.

2024 Federal Income Tax Rates These Rates Apply To Your Taxable Income.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The federal income tax has seven tax rates in 2024: Federal payroll tax rates for 2024 are:

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Fastest SelfEmployment Tax Calculator for 2022 & 2023 Internal Revenue Code Simplified, 6.2% for the employee plus 6.2% for the employer medicare tax rate: 2024 federal income tax rates these rates apply to your taxable income.

Source: www.taxslayer.com

Source: www.taxslayer.com

A Beginner's Guide for SelfEmployment Tax TaxSlayer®, One available deduction is half of the social security and medicare taxes. Employees pay 7.65 percent of their income in social security and medicare taxes with their employers making an additional payment of 7.65 percent.

Source: whattobecome.com

Source: whattobecome.com

23 Self Employment Statistics What To, The federal income tax has seven tax rates in 2024: See current federal tax brackets and rates based on your income and filing status.

Source: payroll.utexas.edu

Source: payroll.utexas.edu

Calculation of Federal Employment Taxes Payroll Services The University of Texas at Austin, You'll use schedule c to calculate net earnings and schedule se to calculate. What is self employment tax rate for 2024 & 2023?

Source: www.wilmingtonbiz.com

Source: www.wilmingtonbiz.com

The Evolution Of SelfEmployment Taxes And The Reasonable Salary by Adam Shay Sponsored Insights, Your taxable income is your income after various deductions, credits, and exemptions have been applied. The federal income tax has seven tax rates in 2024:

![Tax for SelfEmployed Professionals [Infographic]](https://cloudcfo.ph/wp-content/uploads/2019/09/tax-options-1024x1024.png) Source: cloudcfo.ph

Source: cloudcfo.ph

Tax for SelfEmployed Professionals [Infographic], This publication explains both of these methods. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: www.klawsonlaw.com

Source: www.klawsonlaw.com

Understanding the SelfEmployment Tax, What is self employment tax rate for 2024 & 2023? However, the social security portion may only apply to a part of your business.

Source: rumble.com

Source: rumble.com

IRS Schedule C with Form 1040 Self Employment Taxes, You'll use schedule c to calculate net earnings and schedule se to calculate. You pay tax as a percentage of your income in layers called tax brackets.

Source: bestfinanceeye.com

Source: bestfinanceeye.com

Federal Tax Earnings Brackets For 2023 And 2024 bestfinanceeye, Federal payroll tax rates for 2024 are: Normally these taxes are withheld by your employer.

This Publication Explains Both Of These Methods.

Your taxable income is your income after various deductions, credits, and exemptions have been applied.

Employees Pay 7.65 Percent Of Their Income In Social Security And Medicare Taxes With Their Employers Making An Additional Payment Of 7.65 Percent.

12.4% to social security and 2.9% to medicare.